Roadmaps

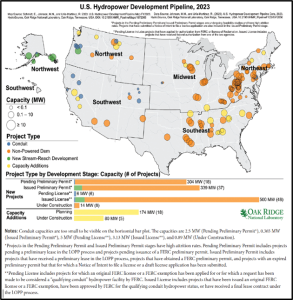

The U.S. 2023 Hydropower development pipeline is presented below, by project location, size, type, and development stage. This map includes both new projects and projects with capacity additions. Twenty-nine states have at least one new hydropower project in the pipeline. With a focus on non-powered dams, the Northeast region has the highest number of proposals (42), with Pennsylvania having the most proposed new projects in the country (26). [1]

Source: DOE Water Power Technologies Office/Oak Ridge National Laboratory [2]

Most conduit projects are in the Northwest and Southwest, where hilly and mountainous topography suits this technology. Alaska is focused on new stream reach, with six proposed projects. Proposals to add to existing capacity are found in all regions. [3]

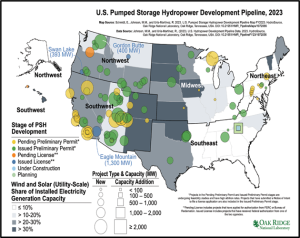

Ninety-six Pumped Storage Hydropower (PSH) projects are in the development pipeline. Twenty-eight states have at least one PSH project in the pipeline, and California and Arizona lead, with 15 and 11 projects, respectively. The U.S. 2023 PSH development pipeline is presented below, by project location, size, and development stage. [4]

Source: DOE Water Power Technologies Office/Oak Ridge National Laboratory [5]

The three PSH projects that have already been licensed by FERC - Eagle Mountain (CA), Gordon Butte (MT), and Swan Lake (OR) - all propose closed-loop configurations. The West Kaua’i Energy Project in Hawaii is a hybrid hydropower example, combining pumped storage, solar, and battery storage. [6]

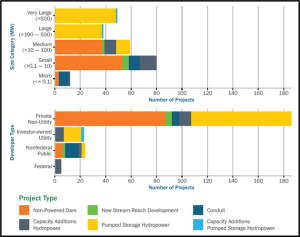

This figure presents the hydropower and PSH project development pipeline by project type, size (MW), and developer type:

Source: DOE Water Power Technologies Office/Oak Ridge National Laboratory [7]

SUMMING IT UP: WHO’S DOING WHAT IN PSH

Private non-utilities—mostly limited liability corporations and a few industrial corporations and educational institutions—are the most active in submitting proposals for Non-Powered Dams (94% of projects) and PSH (82% of projects). [8]

Nonfederal public developers, such as municipalities, state agencies, and irrigation districts, are involved with the majority (65%) of the conduit projects. [9]

Federal hydropower owners - (Army Corps of Engineers (USACE), Bureau of Reclamation, and the Tennessee Valley Authority (TVA) - are focused on maintaining and upgrading their existing hydropower fleets. However, although they are not directly pursuing new projects, both USACE and Reclamation own and operate much of the infrastructure (dams and conduits) that nonfederal developers are seeking to retrofit with hydropower. Therefore, their role in the project development pipeline is more salient than what the above figure indicates. They need to approve projects that involve modifications of the infrastructure they own and operate, and they need to ensure that electricity production does not conflict with the other authorized purposes of the dams or conduits. [10]

Investor-owned utilities are primarily seeking opportunities to add capacity to their fleets, although some have started submitting preliminary permit applications for PSH projects, including PacifiCorp, Public Service Company of Colorado, Dominion Energy, Alabama Power Company, and Duke Energy Carolinas. [11]

Global Hydropower Development Pipeline

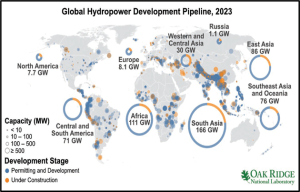

Hydropower is not just expanding in the U.S. This map provides a snapshot of the Global 2023 Hydropower Development Pipeline, by region. With a total capacity of 557 GW proposed globally, South Asia and Africa combined account for 50% of all proposed hydropower. [12]

Source: DOE Water Power Technologies Office/Oak Ridge National Laboratory [13]

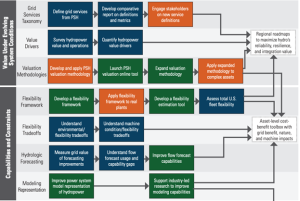

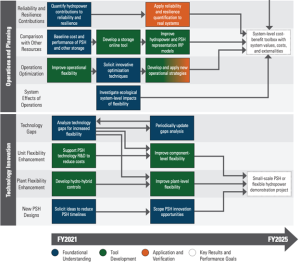

HydroWIRES (Water Innovation for a Resilient Electricity System) is a DOE initiative launched in 2019 to understand, enable, and improve hydropower and PSH’s contributions to U.S. electric grid reliability. [14] Below is the HydroWIRES 2022 Initiative Research Roadmap.

Source: U.S. Department of Energy [15]

Updated by Tina Allen, January 2024

Comments are closed.